Supercharge your on call deposits

Canstar's Savings Bank of the Year 2018 - 2023

We are very proud to be awarded Canstar's Bank of the Year – Savings for the sixth consecutive year! This achievement is awarded to the institution that provides the strongest combination of products, accounting for the price positioning, features, savings tools and flexibility of the products assessed within Canstar’s Savings Account Star Ratings profiles, as well as supporting savers through a competitive Term Deposit offering.

Looking for something else?

Heartland Bank savings accounts are a great way to put aside your money and save for your goals. Here are a few options:

TERM DEPOSITS

6.00

%

p.a.

Minimum investment $1,000.

Find out moreDIRECT CALL

4.60

%

p.a.

No minimum investment, fees or costs.

Find out more32 DAY NOTICE SAVER

5.50

%

p.a.

32 day withdrawal period. Variable rate.

Find out more90 DAY NOTICE SAVER

5.75

%

p.a.

90 day withdrawal period. Variable rate.

Find out moreGot questions?

- Why is it called a Digital Saver Account?

- The Heartland Digital Saver has been designed for customers who are after a competitive interest rate that is accessible via self-service digital tools. Fees are charged on all staff-assisted withdrawals, and therefore the account is better suited to customers who are able to self-service through the Heartland Mobile App and Heartland Digital.

- Are there fees applied to the Digital Saver Account if I withdraw funds?

- Account holders can perform one digital self-service withdrawal a month with no fee. Each additional self-service withdrawal made beyond that will incur a $4 fee. All staff-assisted withdrawals will incur a $10 fee. The interest rate on the account is not reduced, no matter how many withdrawals you make. Refer to our Account and Service Fee Guide for more information about the fees.

- What does a staff-assisted withdrawal mean?

- A staff-assisted withdrawal is when a Heartland staff member is asked to assist with a transfer or withdrawal that is able to be performed via a self-service digital platform (including the Heartland Mobile App and Heartland Digital). Please note that a staff member will inform you before you are charged this fee.

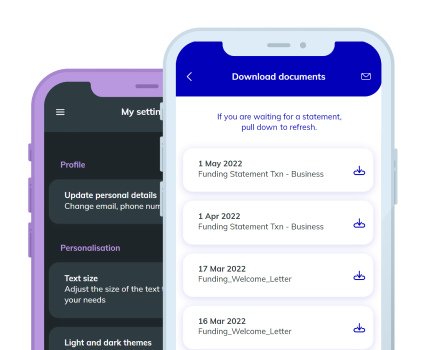

- What can I manage via the Heartland Mobile App or Heartland Digital?

-

You can manage your Digital Saver Account via our self-service platforms (including the Heartland Mobile App and Heartland Digital) including:

- View your balance

- Generate and download statements

- Make payments to a nominated account

- Set up automatic payments and transfers

- What is the minimum deposit to open a Digital Saver Account?

- There is no minimum requirement to open a Digital Saver Account.

- Can I open a Digital Saver Account if I don’t bank with Heartland?

- Yes, you can open a Digital Saver Account without any other Heartland account.

- What is a nominated account?

- A nominated account is one dedicated account of your choice that provides safety when making withdrawals. Once it is set up, any withdrawals from your Digital Saver account will go into this chosen account.

- Can I choose a non-Heartland account as my nominated account?

- Yes, a nominated account can be an account with Heartland or another bank.

- Can I open more than one Digital Saver Account?

- Yes, but you can only open one individual Digital Saver Account and one joint Digital Saver Account per customer. Additional Digital Saver Accounts may also be opened under entities such as companies or trusts.

- Can I open a Digital Saver Account as a trust or a business?

-

Yes, you can open a Digital Saver account as a trust or a business by following the steps below.

If your trust or business is already a Heartland customer, you can open your new Digital Saver account in seconds through the Heartland Mobile App.

If your trust or business is new to Heartland, submit your application under the name of your trust or business by clicking ‘here’. Our team will contact you to collect documents related to your trust or business to finalise your account. - Are there any minimum contribution requirements?

- There are no minimum contribution requirements.

Can't find what you're looking for?

We have a great team standing by to answer any of your investment questions.

Contact us